4 Things to Consider in a Volatile Market

Louis J. Butera, CFP® | August 05, 2022

You may have seen scary headlines going around recently warning about a stock market crash, a possible recession, and interest rates rising. While nobody can predict what will actually occur, there is a lot of uncertainty about what may happen with the market in the next couple of months and years. When there’s a lot of uncertainty, this can translate into a more volatile market that goes up and down as new information about the state of the economy comes out. With that in mind, here are 4 ways you can help prepare your finances for more volatility so you can feel equipped and empowered to take the next step forward.

1. First, Take a Deep Breath

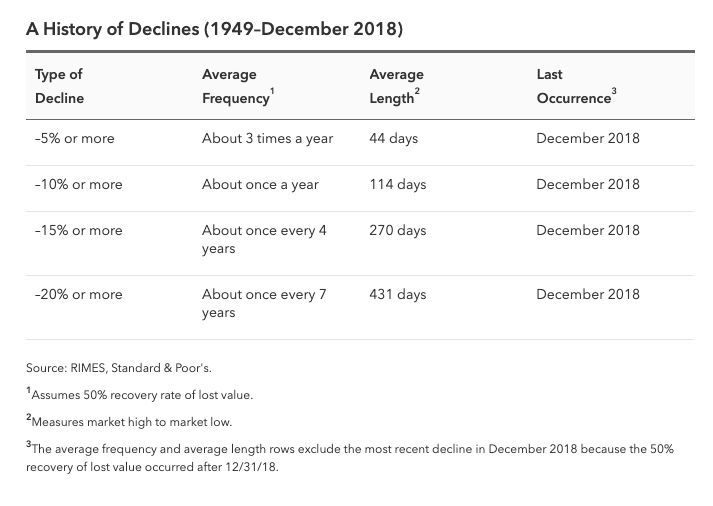

When headlines are dramatic, it’s hard not to respond in kind. But remember, news outlets want to catch your attention, which means they are prone to exaggerate information. Instead, keep a clear head by looking at the stats and put current conditions into perspective. This is not the first time the market has been volatile and it won’t be the last. In fact, declines in the Dow Jones Industrial Average are fairly regular events; drops of 10% or more happen about once a year on average.

Sometimes the market fluctuates in reaction to a global or political event, and sometimes it’s just how the market works. The only long-term guarantee in investing is that there will be short-term fluctuations.

2. Keep a Long-Term Perspective

Now that we know to avoid the headlines and dig for the facts instead of making desperate moves to potentially save our money, here’s an analogy that helps us understand how the stock market and our investments behave. People’s moods can fluctuate on a day-to-day basis and so can the stock market. However, if you look at someone’s personality over a long period of time, their moods average out and usually improve with maturity. This probably doesn’t apply to everyone you know, but stay with me! In the same way, the stock market grows over time. The value of your investments also grows and matures with time, even with short-term ups and downs.

Here is a graph that shows this long-term stability, despite short-term market fluctuations. This is the Dow Jones Industrial Average (DJIA) showing over the last 30 years of investment value, which is a fair representation of the market as a whole.

1

1

If you remember the 2008/2009 crash, as seen above, the market recovered really well. Our current situation may seem significantly different from anything in the past, but capitalism and human perseverance will once again prevail and lead to improvement in the markets.

3. Leave Your Money Alone

Based on what we’ve covered so far, what is going to happen when we ride out the stock market roller coaster and keep investing consistently? We will most likely experience growth, work toward financial confidence, and save ourselves a lot of stress when future downturns come.

When the stock markets go down, you can think of it like a Black Friday or Cyber Monday Sale, where stocks and mutual funds are on sale and you’re getting the best deal on your money. However, if you choose to sell in a down market, you will get a fraction of your money back. You’ll lose money.

If you consistently invest and don’t take any money out until retirement, you can feel more confident about your long-term goals. Don’t become frantic and start selling back everything you bought for a much higher price. Let it grow and mature.

4. Talk to a Professional About Risk

Research will help you keep a clear head and keep you from panic-induced decisions, but when it comes down to it, it’s extremely beneficial to talk with someone who works with this information daily and can help answer concerns specific to your situation and phase of life.

Depending on your age and financial situation, you might not feel like you have as much time to let the market bounce back. This is why it is even more crucial to make sure the types of investments you have make sense considering your risk level. Lower-risk funds don’t go up and down as much as some other more aggressive growth funds. This is something to discuss with a financial professional to make sure your investments are where they should be and are ready for future market swings.

We’re Here to Help!

Understanding the markets and knowing when to buy and sell can be confusing, but remember that you are not alone. We hope you take comfort in knowing that Butera Wealth Management is here for you. We know the volatile markets, among other things, are likely causing you concern regarding your retirement plan. Let us share your burden. Schedule a free, no-obligation phone call by contacting us at 484-455-2661 or louis@buterawm.com to learn how our 2nd Opinion Service can make a difference in your financial life.

About Louis

Louis Butera is the founder and president of Butera Wealth Management, LLC, an independent wealth management firm operating out of Newton Square, Pennsylvania. With over 30 years of experience in the financial services industry, Louis specializes in serving pre-retirees who hold management or executive roles, particularly in the pharmaceutical industry. In 2015, he started his own firm with the express goal and vision of fostering meaningful relationships with clients to help them pursue financial independence and prepare for retirement. Louis and the Butera team provide a customized process to help their clients plan for every aspect of their financial life. Trust has always been key for Louis, and with this foundation, he has helped guide his clients through many different market cycles and life milestones.

Louis is a CERTIFIED FINANCIAL PLANNER™ professional and has a bachelor’s degree in business management from Ithaca College. When he’s not working with his clients, Louis enjoys being outside, playing golf, skiing, and leading an active life with his wife, Michelle. They are both great supporters of local charities and their community. To learn more about Louis, connect with him on LinkedIn.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. No strategy assures success or protects against loss.