How to Reduce Capital Gains Tax

Louis Butera | April 07, 2022

Worrying about capital gains taxes is one of the best problems to have. You were smart (or lucky) enough to make the right investment decisions and now you get to cash in on the appreciation. But all good things come at a cost, and those gains will also come with a tax bill. Taxes are unavoidable, but fortunately, there are things you can do to legally minimize your tax liability. Here are four tips to keep the IRS from taking a big bite out of your capital gains.

1. Wait a Little Longer to Sell

Timing the sale of your investments is critical to lowering your capital gains taxes. Selling your shares after holding for less than a year will result in a short-term capital gains tax. This means that all the gains you made from the sale of the stock will be taxed at your ordinary income rate, which can be 32%-37% for high-earners. (1) Holding on to an asset for more than one year will be taxed at the long-term capital gains tax rate, which can be 0%, 15%, or 20%. (2)

Holding periods are also critical when it comes to the sale of real estate. If you sell your primary home and you lived in the home for at least two years of the five-year period before the sale, the IRS allows you to exclude the first $250,000 of capital gains (or $500,000 for a married couple filing jointly). (3) While the capital gains exclusions do not apply to investment properties, you may be able to utilize like-kind exchanges to defer capital gains tax by reinvesting in other real estate.

2. Utilize Tax-Loss Harvesting (TLH)

Losing money on your investments is usually a bad thing, but utilizing a tax-loss harvesting strategy means you can claim capital losses to offset your capital gains. If you show a net capital loss, you can use the loss to reduce your ordinary income by up to $3,000 (or $1,500 if you are married and filing separately). Losses above the IRS limit can be carried over to future years. (4) Sometimes it is advantageous to sell depreciated assets for this reason. A tax-loss harvesting strategy can help minimize your tax liability and keep more money in your pocket. However, trying to reduce taxes shouldn’t come at the expense of maintaining a thoughtful asset allocation in your portfolio.

3. Asset Location

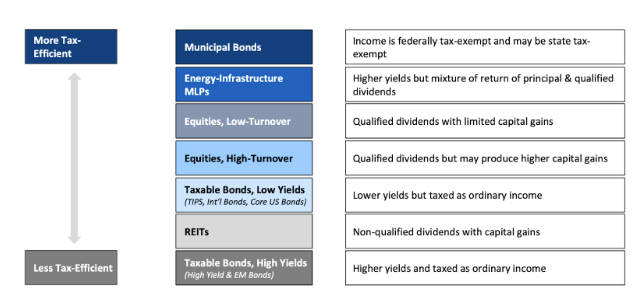

Some investments will be more tax-efficient than others. For example, a municipal bond is considered the most tax-efficient security because income from municipal bonds are federally tax-exempt and may be state tax-exempt. Investments like high-yield bonds are considered less tax-efficient because payments are not tax-exempt, meaning they are taxed as ordinary income.

Like assets, there are investment accounts that are more tax-friendly. Tax-advantaged accounts allow you to defer paying taxes on the gains or earnings to a later date. For example, a traditional IRA or a 401(k) will allow you to contribute using pre-tax income and withdrawals are taxed when you retire, when your income is typically lower.

Pairing tax-advantaged accounts like a 401(k) with tax-inefficient assets like a high-yield bond and pairing taxable accounts (individual, joint, trust, etc.) with more tax-efficient assets will create a more optimal mix to minimize tax liability. Placing investments that have higher tax rates with accounts that delay taxes will help reduce the amount you owe. Since you are not expected to pay federal taxes on something like income from a municipal bond, there is no use placing it in a tax-advantaged account because there are no taxes to delay.

Of course, this is a bit of an oversimplification as there are many nuances that can make certain investment vehicles more tax-efficient than others. For example, although REITs are at the bottom of the chart, there are still plenty of advantages to investing in them. Dividends from REITs are sheltered from corporate tax, and some dividends are considered a return of capital that isn’t taxed at all. This is why it is imperative to work with an experienced professional who can use the nuances of each financial instrument to your advantage.

4. Understand Cost Basis & Share Lots

When you buy any amount of stock, the stock is assigned a lot number regardless of the number of shares. If you have made multiple purchases of the same stock, each purchase is assigned to a different lot number with a different cost basis (determined by the price at the time of each purchase). Consequently, each lot will have appreciated or depreciated in different amounts. Some brokerage accounts use first in, first out (FIFO) by default. If you utilize FIFO, your oldest lots will be sold first. Sometimes FIFO makes sense, but not always. Sometimes it is ideal to sell lots with the highest cost basis, which is commonly done as part of a tax-loss harvesting strategy.

Passing on assets as an inheritance can also increase your cost basis. Assets passed on to the next generation at the time of death allow your heirs to pay tax only on capital gains that occur after they inherit your property, through a one-time “step up in basis.” (5) For example, when one spouse dies, assets passed on to the surviving spouse will have a cost basis of the price of the asset on the day in which they passed. This eliminates the deceased spouse’s portion of capital gains.

We’re Here to Help

Minimizing capital gains taxes is only one component of your financial well-being. After all, having to pay capital gains taxes is a positive sign that your investment strategies are doing well. Reaching your financial goals requires a holistic approach that takes many factors into consideration. Partnering with a financial professional can help you create a plan that is optimized to reach your financial goals. Schedule a free, no-obligation phone call by contacting us at 484-455-2661 or louis@buterawm.com to learn how our 2nd Opinion Service can make a difference in your financial life.

About Louis

Louis Butera is the founder and president of Butera Wealth Management, LLC, an independent wealth management firm operating out of Newton Square, Pennsylvania. With over 30 years of experience in the financial services industry, Louis specializes in serving pre-retirees who hold management or executive roles, particularly in the pharmaceutical industry. In 2015, he started his own firm with the express goal and vision of fostering meaningful relationships with clients to help them pursue financial independence and prepare for retirement. Louis and the Butera team provide a customized process to help their clients plan for every aspect of their financial life. Trust has always been key for Louis, and with this foundation, he has helped guide his clients through many different market cycles and life milestones.

Louis is a CERTIFIED FINANCIAL PLANNER™ professional and has a bachelor’s degree in business management from Ithaca College. When he’s not working with his clients, Louis enjoys being outside, playing golf, skiing, and leading an active life with his wife, Michelle. They are both great supporters of local charities and their community. To learn more about Louis, connect with him on LinkedIn.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.

Investing in Real Estate Investment Trusts (REITs) involves special risks such as potential illiquidity and may not be suitable for all investors. There is no assurance that the investment objectives of this program will be attained.

This material was prepared for Louis Butera’s use.

______________

(1) https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

(2) https://www.irs.gov/taxtopics/tc409

(3) https://www.irs.gov/taxtopics/tc701